WTF Dailies August 13, 2025

Asian stock markets climbed on Wednesday in broad-based buying, tracking sharp overnight gains on Wall Street after mild U.S. inflation data fueled Fed rate-cut hopes, while Japan’s Nikkei extended its record-setting rally.

- Asian stock markets climbed on Wednesday in broad-based buying, tracking sharp overnight gains on Wall Street after mild U.S. inflation data fueled Fed rate-cut hopes, while Japan’s Nikkei extended its record-setting rally.

- Shares in Sydney fell against the regional trend, as earnings from heavyweight Commonwealth Bank of Australia (ASX:CBA) pulled the broader financial sector lower.

- Wall Street saw sharp gains on Tuesday, with the S&P 500 and NASDAQ Composite hitting fresh record highs.

- U.S. stock index futures also traded higher in Asian trade on Wednesday, with tech-heavy Nasdaq leading gains.

- Tokyo’s Nikkei 225 continued its rally, rising 1.5% to 43,347.31 points, reaching another record high.

- Japan’s broader TOPIX index also climbed to a record high with its sixth consecutive intraday rise. It traded 1% higher on Wednesday at 3,098.33 points.

- Investors were encouraged by the U.S. Consumer Price Index rising just 0.2% in July and an annual increase of 2.7%, figures seen as mild enough to support expectations of a September rate cut.

- Markets are now pricing in nearly a 94% probability of a 25 basis point cut next month, according to CME’s Fedwatch tool

- In China, the Shanghai Composite index gained 0.3%, while the Shanghai Shenzhen CSI 300 rose 0.4%.

- Hong Kong’s Hang Seng index jumped 1.3% on Wednesday.

- South Korea’s KOSPI index advanced 0.5%, while Singapore’s Straits Times Index jumped 0.8%.

- Futures tied to India’s Nifty 50 were largely unchanged.

- In Australia, the S&P/ASX 200 retreated 0.5% from record high levels as earnings from the top banker, Commonwealth Bank of Australia (OTC:CMWAY), weighed on the financial sector. The bank reported a record full-year profit but saw its shares decline more than 5% to a three-month low on valuation concerns and reliance on volatile trading income.

- A day earlier, the Reserve Bank of Australia reduced interest rates by 25 basis points to 3.60%, and signaled it had room to cut rates again this year.

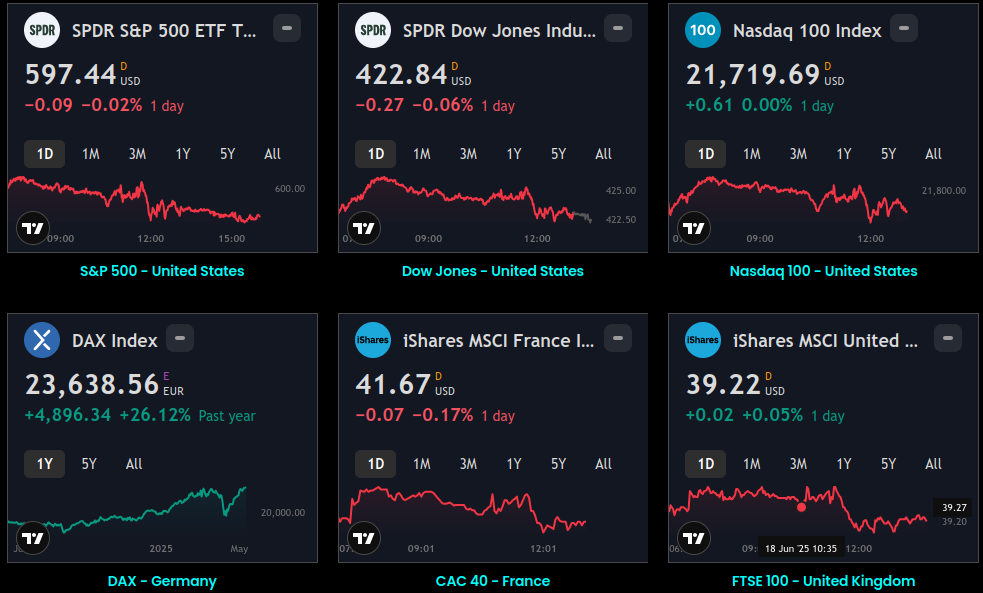

Market Close

- Equity markets rose on Wednesday, with the S&P 500 and Nasdaq reaching record highs. Investors are awaiting producer inflation for July, to be released tomorrow, which is forecast to rise. Materials and health care stocks posted the largest gains, while the communication and consumer staples sectors trailed. Small- and mid-cap stocks led large-cap stocks on the day, likely benefitting from the prospects for the Fed to resume interest rate cuts, in our view. Bond yields fell, with the 10-year U.S. Treasury yield at 4.24%, below its July peak near 4.50%.

- In international markets, Asia and Europe finished mostly higher.

- The U.S. dollar declined against major international currencies.

- In commodity markets, WTI oil traded lower on an International Energy Agency report raising its supply forecast and cutting its projection for demand.

- The producer price index (PPI) for July will be released on Thursday, with forecasts calling for the headline figure to edge higher to 2.4% year-over-year. Wholesale inflation moderated through the first half of this year, falling sharply from 3.8% in January to 2.3% in June. Core PPI, which excludes more-volatile food and energy prices, is also expected to rise to 2.9% annualized, from 2.6% in June. These readings, if in line with estimates, likely reflect the early impact of tariffs, as higher import costs are at least partially passed along within supply chains.

- Bond markets are pricing in inflation of about 2.38% over the next 10 years, indicating that long-term inflation expectations remain relatively well anchored.

- With 91% of S&P 500 companies reporting quarterly results, corporate earnings season is winding down. Earnings results have been stronger than expected, as 82% of S&P 500 companies have beaten analyst estimates, with an average upside surprise of 8.5%. As a result, forecasts for earnings growth have been revised sharply higher to 10.3%, from 3.8% at the end of the quarter, showing that prior downgrades appear to have been overdone.

- Earnings growth has been led by the communications and technology sectors, both of which are higher more than 20% year-over-year. Performance has been broad as well, as earnings are down for just one of the 11 sectors — energy — which represents less than 3% of the market capitalization of the S&P 500.

- Earnings growth is forecast to slow over the quarters ahead but still combine for 10.3% growth for 2025, aided by the first quarter's strong 12.8% rise.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.