WTF Dailies August 28, 2025

US stock futures mostly fell after Nvidia (NVDA) stock tumbled, with the company's earnings beat overshadowed by weaker-than-expected data sales revenue.

- US stock futures mostly fell after Nvidia (NVDA) stock tumbled, with the company's earnings beat overshadowed by weaker-than-expected data sales revenue.

- Nvidia earnings beat on the top and the bottom lines, but its data sales revenue missed expectations, spooking investors and raising fresh questions about the sustainability of the AI boom. Meanwhile, the chip giant's total revenue hit a record but also showed its slowest pace of growth since the first quarter of its fiscal year 2024.

- Most Asian stocks rose marginally on Thursday with technology shares treading water as investors digested somewhat mixed earnings from artificial intelligence major Nvidia Corp.

- Hong Kong shares were the worst performers for the day, hit by steep losses in food delivery major Meituan and its rivals.

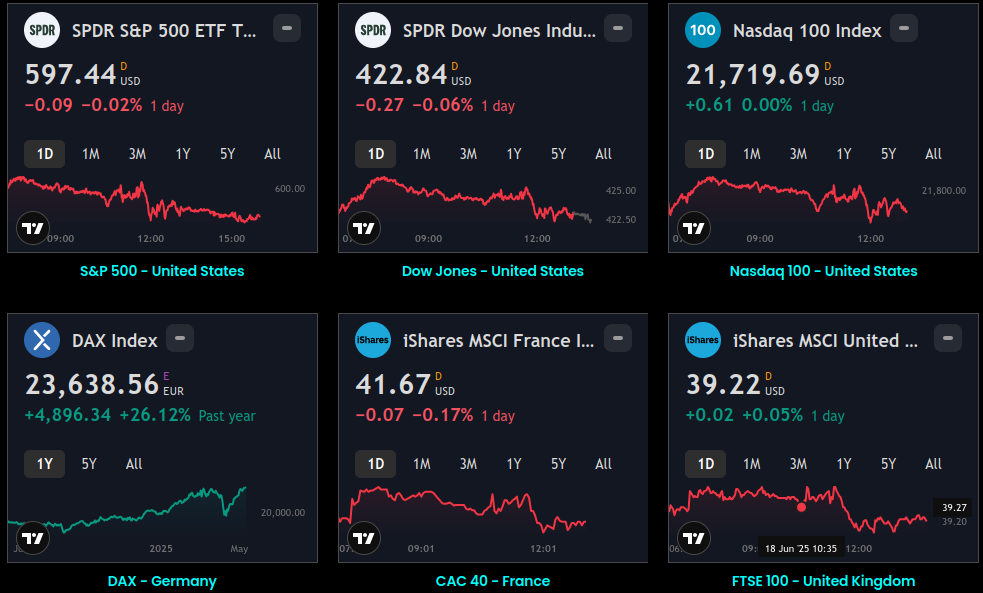

- Barring tech, regional markets took some positive overnight cues from Wall Street, where the S&P 500 inched up to a record high.

- Japan’s Nikkei 225 index rose 0.5%, while the broader TOPIX added 0.4% as tech stocks clocked a somewhat mixed reaction to Nvidia’s earnings.

- Among other tech majors, South Korea’s KOSPI rose 0.4% after the Bank of Korea kept interest rates unchanged, as expected.

- Nvidia suppliers SK Hynix Inc (KS:000660) and Samsung Electronics Co Ltd (KS:005930) both moved in a tight range.

- Taiwan’s TSMC (TW:2330), which is among Nvidia’s biggest Asian suppliers, fell 1.3% in Taipei trade, while Hon Hai Precision Industry Co Ltd (TW:2317), also known as Foxconn, shed 1%.

- Hong Kong’s Hang Seng index shed 1%, lagging its regional peers as a batch of weak earnings weighed on the index.

- Meituan (HK:3690) slid as much as 10% and was the worst performer on the Hang Seng after the food delivery giant clocked dismal second-quarter earnings and presented a weak outlook, amid rapidly intensifying competition in the sector. Rivals Alibaba Group (HK:9988) and JD.com (HK:9618) fell more than 3% each.

- Indian equity benchmark indices, tanked in opening trade on Thursday a day after 50% US tariffs came into effect on India

Market Close

- NVIDIA's solid results – ahead of analyst estimates for both earnings and revenue - appeared to boost sentiment, lifting the S&P 500 to a record high on Thursday.

- Communication and energy stocks led markets higher, while the value-focused utility and consumer staples sectors trailed.

- The 10-year U.S. Treasury yield dipped to 4.21%, easing from its July peak near 4.50%.

- The second estimate for U.S. real GDP growth in the second quarter was revised up to 3.3%, from the 3.0% advance estimate, driven by stronger fixed investment.

- In international markets, Asia finished mixed overnight as South Korea's central bank held its policy rate steady at 2.50%, as expected, and 50% U.S. tariffs on imports from India went into effect.

- The U.S. dollar weakened against major currencies.

- In commodity markets, WTI oil rose amid geopolitical tensions as Russian launched airstrikes on Ukraine.

- Initial jobless claims fell to 229,000 this past week, slightly above estimates pointing to 227,500. Continuing claims, which measures the total number of people receiving benefits, dropped to 1.95 million from 1.96 million the prior week. The broader trend for jobless claims has been higher this year, indicating the labor market remains healthy but is cooling from a position of strength

- The unemployment rate remains low at 4.2%, and 7.4 million job openings still exceed unemployment of 7.2 million.

- Personal consumption expenditure (PCE) inflation for July will be released on Friday, with the headline figure expected to hold steady at 2.6% annualized. Core PCE, which excludes more-volatile food and energy prices, is forecast to rise to 2.9%, from 2.8% the prior month. While PCE inflation remains above the Federal Reserve's 2% target, bond markets are pricing in expectations for two more cuts to the fed funds rate this year, likely starting in September, and an additional three cuts next year.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.