WTF Dailies July 1, 2025

Japan’s Nikkei 225 fell 1.2% to 40,003.24 despite positive results of the central bank's quarterly Tankan survey of large manufacturers, which showed an better than expected improvement in business sentiment. President Trump sharply criticised ongoing trade negotiations with Japan on Monday

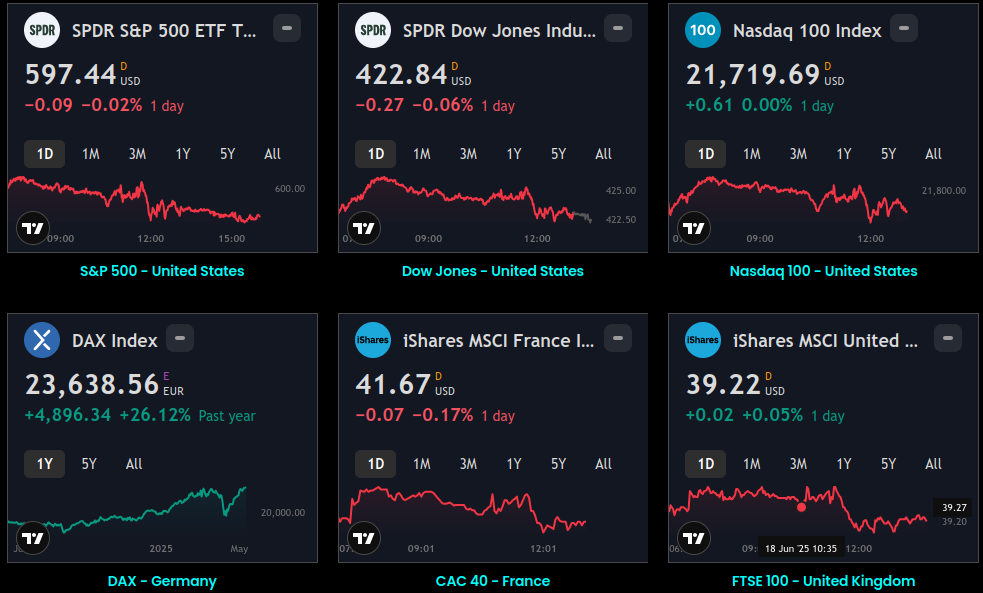

- US stock futures held steady as investors weighed improved market sentiment following fresh record highs. Futures attached to the Dow Jones Industrial Average, the benchmark S&P 500 and the tech-heavy Nasdaq 100 slipped 0.1%.

- Meanwhile, the Senate is making a final push to advance Trump's signature legislation. A final vote could come as soon as Tuesday even as last-minute changes have pushed the bill's price tag up by nearly $1 trillion.

- With markets increasingly optimistic that an interest rate cut from the Federal Reserve could be around the corner, Thursday's job report is in high focus this week. Investors will be watching for signs of cooling in the labor market, which could bolster the case for a cut sooner rather than later.

- Asian shares are mostly higher after U.S. stocks added to their records with the close of a second straight winning month.

- Japan’s Nikkei 225 fell 1.2% to 40,003.24 despite positive results of the central bank's quarterly Tankan survey of large manufacturers, which showed an better than expected improvement in business sentiment. President Trump sharply criticised ongoing trade negotiations with Japan on Monday, complaining that Tokyo refuses to import American-grown rice, despite claiming to have a domestic shortage.

- The Shanghai Composite index added 0.2% to 3,451.69 after China’s official manufacturing purchasing managers index, or PMI, rose to a three-month high of 49.7 in June while the PMI for services and other non-manufacturing businesses also rose to a three-month high of 50.5.

- Hong Kong's stock market was closed on Tuesday.

- South Korea’s KOSPI Composite Index surged 1.5% to 3,117.17 after the government reported that exports bounced back in June, helped by strong demand for semiconductors, ships and health products.

- Australia's S&P/ASX 200 edged up 0.1% to 8,550.80.

- Nifty50 and BSE Sensex, the Indian equity benchmark indices, opened in green on Tuesday. While Nifty50 was above 25,500, BSE Sensex was marginally up. At 9:16 AM, Nifty50 was trading at 25,525.55, up 9 points or 0.033%. BSE Sensex was at 83,636.03, up 30 points or 0.035%.Market participants are awaiting commentary from the US Federal Reserve Chairperson for directional guidance.

- Trading will end early on Thursday at 1 p.m. ET due to the Fourth of July holiday.Bond yields fell, with the 10-year Treasury yield at 4.24%. The benchmark yield has pulled back from its May peak near 4.60%. Bond markets are pricing in expectations for three cuts to the fed funds rate this year, above the Fed's own forecast for two cuts.Resilient, though likely slower, economic growth could cut demand for credit and loans, which can reduce the difference between long- and short-term interest rates, known as a flatter yield curve.

Market Close

- Equity markets finished lower on Tuesday, pulling back from record highs. Materials and health care stocks posted the largest gains, while the communication and tech sectors lagged. Bond yields rose, with the 10-year Treasury yield at 4.25%. In international markets, Asia finished mixed overnight, as a key manufacturing Purchasing Managers' Index (PMI) for China rose to 50.4 in June, ahead of forecasts and reflecting expansion. Europe was mostly lower, as the flash estimate for eurozone CPI inflation ticked up to 2.0% annualized in June, as expected and in line with the European Central Bank's target. The U.S. dollar extended its decline against major international currencies. In commodity markets, WTI oil traded higher as markets await the outcome of the OPEC+ meeting on July 6.

- The final S&P U.S. Manufacturing PMI rose to 52.9 in June, well above estimates calling for a drop to 49.3. The figure remained above the key 50.0 mark reflecting expansion for the sixth consecutive month. The Institute for Supply Management (ISM) Manufacturing PMI rose to 49.0, narrowly missing forecasts for a larger increase to 49.1. Within ISM's components, supplier deliveries and production were the largest positive contributors, while employment and new orders were the main detractors.

- Job openings rose to 7.8 million in May, beating forecasts to decline to 7.3 million. The number of people voluntarily leaving their jobs (quits) held about steady at 3.3 million, typically indicating confidence in employment prospects, while layoffs and discharges were little changed.

- Trump's "One Big Beautiful Bill" cleared the Senate, with Vice President JD Vance casting the tie-breaking vote. The bill now heads to the House, where Speaker Mike Johnson aims to pass the legislation by Thursday, July 4. Economists estimate the bill's final price tag could top $4 trillion.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.