WTF Dailies June 16, 2025

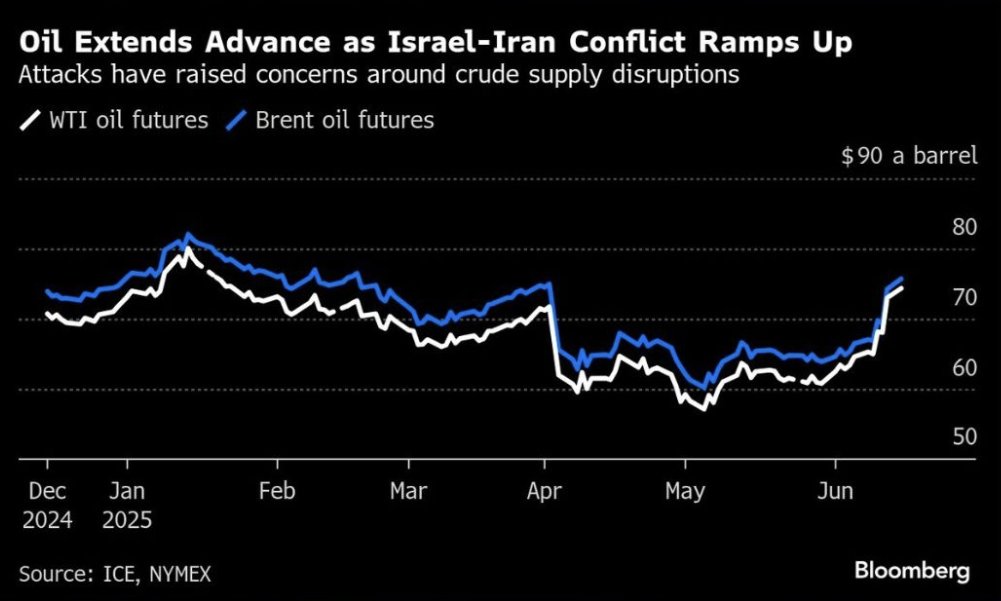

Israel and Iran have been engaged in a fierce exchange of fire for three consecutive days. According to Israel’s emergency service Magen David Adom, Iranian strikes have killed at least ten people, bringing the total death toll to 13. In Iran, Israeli strikes have caused 406 deaths and 654 injuries

- Israel and Iran have been engaged in a fierce exchange of fire for three consecutive days. According to Israel’s emergency service Magen David Adom, Iranian strikes have killed at least ten people, bringing the total death toll to 13. In Iran, Israeli strikes have caused at least 406 deaths and 654 injuries, according to the group Human Rights Activists. The Iranian government has not released official casualty figures yet.

- Two US officials told CNN the president rejected an Israeli plan to kill Iran’s Supreme Leader Ayatollah Ali Khamenei. Israeli Prime Minister Benjamin Netanyahu strongly denied the reports of such a plan. Trump also said he wants to see a deal reached between Israel and Iran and that he believes “there’s a good chance” of that happening, but he also said that “sometimes they have to fight it out.”

- World leaders urgently called for de-escalation in order to prevent an all-out war. Russian President Vladimir Putin had condemned Israel’s strikes on Iran and expressed concern over further escalation. In a phone call with US President Donald Trump on Saturday, Putin reiterated Moscow's willingness to facilitate negotiations.

- Oil prices continued to soar on Sunday, adding to the 7% surge from last week, as the conflict threatens global oil supply.WTI crude oilfutures surged 1.11% as trading hovered around $73.79 a barrel.

- US Stock futures rose early Monday as the escalating conflict between Israel and Iran spiked oil prices and raised investors’ concerns about the global economy. Dow Jones Industrial Average futures moved up 63 points, or 0.15%. S&P 500 futures added 0.24%, while Nasdaq 100 futures rose 0.36%.

- Most Asian stocks moved little on Monday as a sustained conflict between Iran and Israel kept risk appetite on the backfoot, as did anticipation of a barrage of central bank meetings this week. Mixed economic readings from China kept local stocks trading sideways.

- Focus this week is squarely on a barrage of central bank meetings, starting with the Bank of Japan on Tuesday. The Federal Reserve is set to decide on rates on Wednesday, while the Bank of England, Swiss National Bank, and the People’s Bank of China will also decide on rates later this week.

- Chinese stocks flat after mixed industrial prod, retail sales data

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes moved less than 0.1% each, while Hong Kong’s Hang Seng index lost 0.2%. - Government data released on Monday showed Chinese industrial production grew slightly less than expected in May, amid increased pressure from U.S. trade tariffs. But Chinese retail sales growth blew past expectations, signaling some resilience in consumer spending despite increased economic uncertainty. The mixed economic prints sparked even more uncertainty over the Chinese economy, as it grapples with a U.S. trade war and a sustained deflationary trend.

- Washington and Beijing had last week announced some progress in their trade negotiations, although no permanent deal was announced. Reuters reported that the recent deal also left the issue of China’s rare earth export controls unresolved, amid mounting concerns over supply shortages.

- The PBOC is set to decide on its benchmark loan prime rate later this week, after cutting the rate earlier this year.

- Japan’s Nikkei 22 upbeat before BOJ rate decision. Japanese stocks outpaced their peers on Monday, with the Nikkei 225 adding 1%, while the TOPIX rose 0.6%.

- Focus was largely on the BOJ, which is set to leave interest rates unchanged on Tuesday. But traders are growing increasingly confident that the central bank will raise interest rates by July, especially amid increasing Japanese inflation and signs of resilience in the economy.

- Inflation is expected to be further underpinned by recent wage hikes in the country, giving the BOJ more impetus to hike rates. Governor Kazuo Ueda said as much in a parliamentary address last week, stating that the BOJ will hike rates further as inflation rises.

- Broader Asian markets were a mixed bag as investors grappled with heightened tensions in the Middle East and persistent uncertainty over U.S. trade policy.

- South Korea’s KOSPI continued to outperform after investors welcomed the liberal party winning the presidential election earlier this month. The KOSPI rose 0.7% was close to a 3-½ year high.

- India's benchmark equity indices rebounded on Monday after a two-day decline driven by an escalating Israel-Iran conflict, tracking gains in Asian markets and a dip in domestic volatility. The Sensex jumped 557.24 points or 0.69 percent to 81,675.84. The broader Nifty surged 184.05 points or 0.74 percent to 24,902.65. SBI Life Insurance Company, Oil & Natural Gas Corporation, Hero MotoCorp, HDFC Life Insurance Company and Cipla were among the major gainers, rising up to 3 percent.

Events and Earnings Calendar:

https://worldtradefactory.ghost.io/events/

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.