WTF Dailies June 23, 2025

The world is bracing for Iran's response after the U.S. attacked key Iranian nuclear sites, joining Israel in the biggest Western military action against the Islamic Republic since its 1979 revolution.

- The world is bracing for Iran's response after the U.S. attacked key Iranian nuclear sites, joining Israel in the biggest Western military action against the Islamic Republic since its 1979 revolution. Iran vowed to defend itself a day after the U.S. dropped 30,000-pound bunker-buster bombs onto the mountain above Iran's Fordow nuclear site while American leaders urged Tehran to stand down and pockets of anti-war protesters emerged in U.S. cities.

- The dollar strengthened on Monday as investors sought to shield against mounting geopolitical risks following the US strikes on Iran.

- The US currency gained against the euro and most major foreign-exchange peers in Asia trading. Crude oil futures climbed and US equity contracts slipped as the bombing fueled demand for safety and angst about energy supply. Treasuries dipped, reversing an earlier gain.

- Market reaction had been generally muted since Israel’s initial assault on Iran earlier this month: Even after falling for the past two weeks, the S&P 500 is only about 3% below its all-time high from February. And a Bloomberg gauge of the greenback is up more than 1% since the June 13 attack as of Monday in Asia.

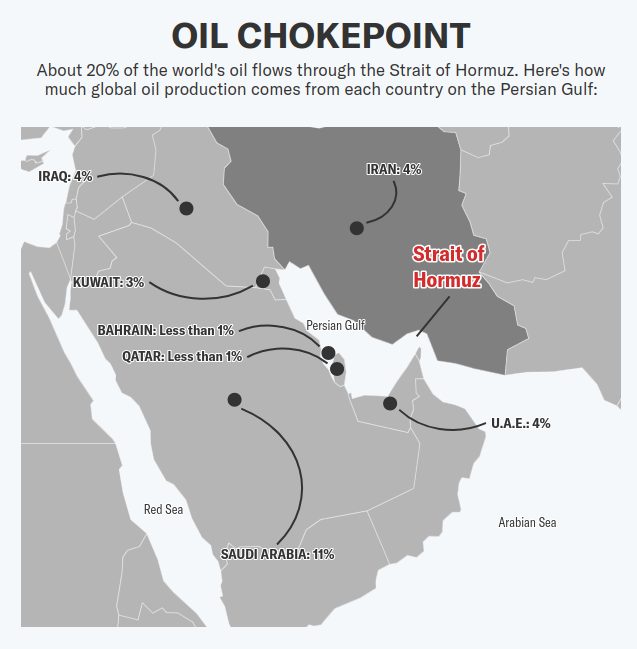

- That’s mostly because investors have expected the conflict to be localized, with no wider impact on the global economy. But moves stand to get bigger if Iran responds to the latest developments with steps such as blocking the Strait of Hormuz, a key passage for oil and gas shipments, or attacking US forces in the region, market watchers say.

- Most Iranian oil flows to China but the closing the Strait of Hormuz would jeopardize a wider array of oil and natural gas sources with Saudi Arabia, Kuwait, Iraq and others using that waterway but impacts Iran the most as the primary revenue source.

- Iran has vowed to impose “everlasting consequences” for the bombing and said it reserves all options to defend its sovereignty. Meanwhile, Israel resumed its assaults, targeting military sites in Tehran and western Iran.

- The biggest market reaction since the start of the escalation has been in oil. Traders are preparing for another surge in crude prices even as it’s unclear where the crisis goes from here. Global benchmark Brent surged as much as 5.7% to $81.40 a barrel in Asia, before paring much of that gain in heavy trading.

- Asian stocks fell on Monday as risk appetite was battered by the U.S. attacking Iran’s nuclear sites over the weekend, marking a potentially dire escalation in the Middle Eastern conflict.

- S&P 500 Futures fell 0.3% in Asian trade, although analysts noted that risk assets were proving to be more resilient than expected.

- Australia’s ASX 200 was among the worst performers for the day, down nearly 0.8% despite slightly upbeat PMI data for June.

- China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes fell 0.4% and 0.1%, while Hong Kong’s Hang Seng index lost 0.6%. Beijing condemned the U.S. attack and called on Israel to reach a ceasefire in the region.

- Gift Nifty 50 Futures for India’s Nifty 50 index fell 0.1%, heralding a weak open, while South Korea’s KOSPI and Singapore’s Straits Times index shed between 0.5% and 0.7%.

- Japan’s Nikkei 225 and TOPIX indexes lost about 0.5% each, weakening despite upbeat PMI data for June. Japan’s manufacturing sector grew in June, its first monthly rise in 11 months, as local output and inventory growth helped offset soft demand. Japan’s services sector also grew at a faster pace, indicating local demand was improving on the back of higher wages.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

TThis daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.