WTF Dailies June 24, 2025

Trump said Israel and Iran had agreed to a “complete and total ceasefire” soon after Iran launched limited missile attacks Monday on a U.S. military base in Qatar, retaliating for the American bombing of its nuclear sites over the weekend.

- Trump said Israel and Iran had agreed to a “complete and total ceasefire” soon after Iran launched limited missile attacks Monday on a U.S. military base in Qatar, retaliating for the American bombing of its nuclear sites over the weekend. Uncertainty remained, with Israel not immediately confirming any ceasefire. It was unclear what the missile launches would do for the ceasefire’s timeline.

- Iranian Foreign Minister Abbas Araghchi said no ceasefire has been agreed yet with Israel, and a final decision will be made at a later time. As investors awaited more details on the tentative truce, a broader risk-on sentiment boosted regional stocks.

- U.S. futures advanced, as contracts for the S&P 500 and the Dow Jones Industrial Average gained 0.5%.

- Asian stock markets saw sharp gains on Tuesday, led by South Korea and Hong Kong, after U.S. President Donald Trump announced a tentative ceasefire between Israel and Iran, lifting investor risk appetite.

- South Korea’s KOSPI index led gains with a 2.5% jump, with heavyweight Samsung Electronics (KS:005930) stock rising 3.5%.

- Hong Kong’s Hang Seng index jumped 1.8%.

- Japan’s Nikkei 225 gained nearly 1%, while the broader TOPIX index advanced 0.8%.

- China’s Shanghai Composite index climbed 0.9%, and the Shanghai Shenzhen CSI 300 jumped 1.1%.

- Singapore’s Straits Times Index rose 0.5%, while Indonesia’s Jakarta Stock Exchange Composite Index surged more than 2%.

- India’s Nifty 50 Futures were also trading 1% higher, while the Philippines’ PSEi Composite index rallied 2%.

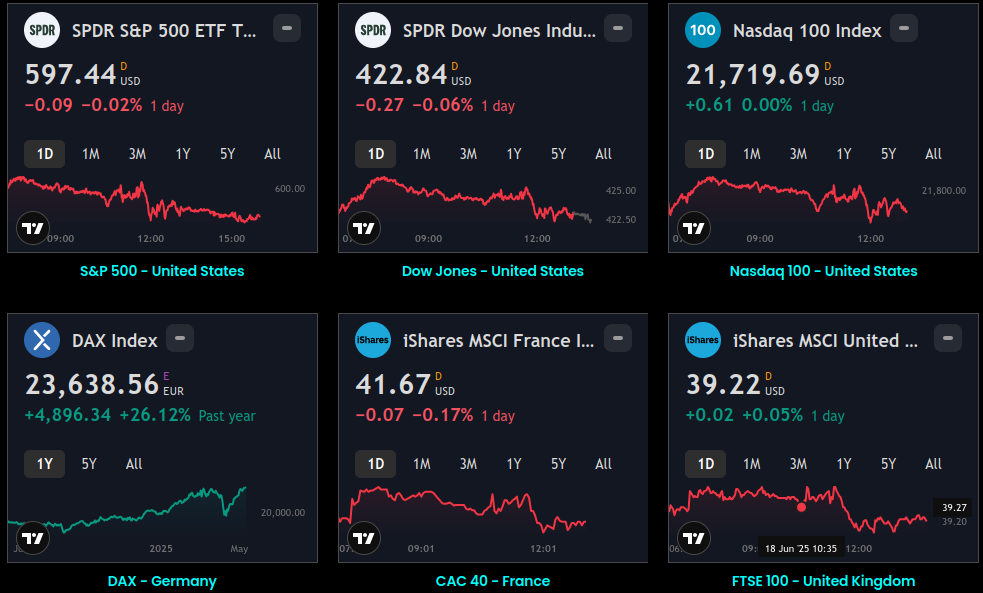

Market Close

- Equity markets closed higher on Tuesday following a ceasefire between Israel and Iran. While there has been some uncertainty on timing, Israel's prime minister Benjamin Netanyahu has commented that the ceasefire is in effect. Bond yields fell, with the 10-year U.S. Treasury yield at 4.29%, below its May peak near 4.60%. Technology and financial stocks led markets to the upside, while the energy and consumer staples sectors lagged. In international markets, Asia and Europe finished broadly higher.The U.S. dollar declined against major international currencies. In commodity markets, WTI oil extended its decline from yesterday as supply concerns appear to have eased on the Israel-Iran ceasefire. Global oil prices have fallen below the mark when Israel initially launched airstrikes against Iran on June 12.

- The S&P CoreLogic Case-Shiller 20-City Composite Home Price index fell by 0.3% month-over-month in April, below expectations for a 0.1% rise. The annual rise in the measure cooled to a 3.4% pace, down from 4.1% a month earlier.* Slower home-price increases have helped reduce the shelter component of CPI inflation to 3.9% annualized in May, down from 5.1% a year ago*, providing a key driver in moderating inflation.

- The Conference Board's Consumer Confidence Index declined to 93.0 in June, below forecasts to improve to 99.0. Pessimism about future business conditions and employment prospects were key detractors. Tariffs and their potential impact on the economy and inflation remained top of consumers' minds in write-in responses. Inflation expectations for the next 12 months ticked down to 6.0%, from 6.4% in May and 7.0% in April. Intentions to purchase homes declined, while plans to buy cars held steady.

- In prepared remarks released on Tuesday, Powell indicated that the central bank is prepared to maintain current interest rates while monitoring economic developments. He described the U.S. economy as being in a "solid position" despite elevated uncertainty, with the unemployment rate remaining low at 4.2% in May. He noted that labor market conditions are "broadly in balance and consistent with maximum employment." The Fed Chair acknowledged that inflation has "eased significantly" from its mid-2022 peaks but remains above the central bank’s 2% target. Total personal consumption expenditures prices rose 2.3% for the 12 months ending in May, while core PCE prices, excluding food and energy, increased 2.6%. Facing a grilling from House lawmakers over why the Fed is not moving quickly to slash rates, an often-repeated demand from Trump, Powell said officials are wary that price gains could accelerate again soon due to the implementation of elevated U.S. tariffs.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

TThis daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.