WTF Dailies June 26, 2025

U.S. gross domestic product shrank by an annualized 0.5% in the first quarter, according to a final revision of the data on Thursday which confirmed the first contraction since 2022 and suggested possible headwinds from sweeping U.S. tariffs.

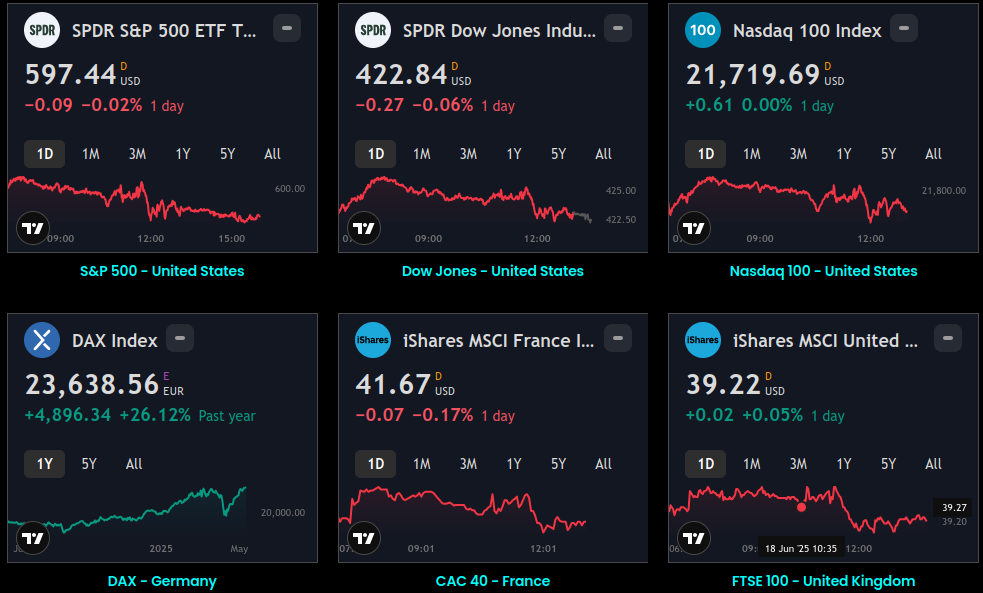

- U.S. stocks edged higher Thursday, with investors buoyed by the holding ceasefire between Israel and Iran even with data showing an economic slowdown.

- At 09:35 ET (13:35 GMT), the Dow Jones Industrial Average rose 190 points, or 0.4%, the S&P 500 index gained 24 points, or 0.4%, and the NASDAQ Composite climbed 65 points, or 0.3%.

- The main averages on Wall Street ended in mixed fashion on Wednesday, pausing a two-day rally, as investors gauged a ceasefire between Israel and Iran and assessed testimony from Federal Reserve Chair Jerome Powell.

- The three benchmark indexes are on pace for a positive week, and the benchmark S&P 500 less than 1% below its February record.

- Tensions in the Middle East seemed to be calming, with the ceasefire between Israel and Iran appearing to hold, and the U.S. planning to meet with Iran next week.

- U.S. gross domestic product shrank by an annualized 0.5% in the first quarter, according to a final revision of the data on Thursday which confirmed the first contraction since 2022 and suggested possible headwinds from sweeping U.S. tariffs.

- In the prior revised figure released in May, January-to-March GDP contracted by 0.2%, marking a reversal from growth of 2.4% in the final three months of 2024.

- The number of Americans filing new applications for jobless benefits fell 10,000 last week, but the unemployment rate could rise in June as more laid off people struggle to find work.

- May’s personal consumption expenditures price index reading, the Fed’s preferred gauge of inflation, is due out on Friday, and will be studied carefully for clues over when the U.S. central bank next easing monetary policy.

- European stocks are higher in mid-day trading as Germany's consumer confidence index unexpectedly ticked down.

- Overnight in Asia, stocks were mixed as investors await key Japanese economic data later today, including the Tokyo Consumer Price Index, jobless rate, and retail sales.

- Federal Reserve Chair Jerome Powell maintained a wait-and-see approach to future interest rate decisions in his comments to Congressional lawmakers this week, saying this strategy is appropriate until more clarity emerges around the impact of aggressive U.S. tariffs on the broader economy.

- Crude prices rose, adding to the previous session’s gains, as a larger-than-expected draw in U.S. crude stocks signalled firm demand from the world’s largest consumer.

- U.S. crude inventories fell by 5.8 million barrels, the Energy Information Administration said on Wednesday, and gasoline stocks unexpectedly fell by 2.1 million barrels, as gasoline supplied, a proxy for demand, rose to its highest since December 2021.

Market Close

- U.S. equity markets traded higher on Thursday, with the S&P 500 closing just a handful of points off its February 19 all-time high. Leadership was broad-based, with most sectors of the S&P 500 closing higher and led by growth-oriented sectors, such as communication services, along with cyclical sectors, such as energy and industrials. Overseas, European markets were mixed following a lower-than-expected consumer confidence reading in Germany, while markets in Asia were mixed overnight. On the economic front, first-quarter real GDP growth was revised lower to a 0.5% annualized contraction, while initial jobless claims for last week were below expectations. In bond markets, yields finished slightly lower, with the 10-year Treasury yield falling to 4.24% and the 2-year yield finishing around 3.72%.

- Despite policy-driven volatility earlier this year, U.S. equity markets have rallied sharply over the past two months, with the S&P 500 closing just below its February 19 all-time high on Thursday. Easing trade tensions, resilient economic data, and strong first-quarter corporate earnings have fueled a more than 20% gain in the S&P 500 since the April 8 low.

- The third estimate for first-quarter real GDP growth was released this morning and showed that the U.S. economy slowed more than initially expected. Real GDP contracted at a 0.5% annualized rate, down from the prior estimate of 0.2%. The downward revision was primarily driven by weaker-than-expected consumer spending and exports. Continuing claims, however, ticked up to 1.97 million, the highest since November 2021, potentially signaling that unemployed individuals are finding it more difficult to secure new jobs. Expectations are for headline PCE to rise 0.1% month-over-month and 2.3% year-over-year, while core PCE (which excludes food and energy) is also expected to increase 0.1% for the month and 2.6% annually.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

TThis daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.